Proof of Income for Mortgages: Income and Asset Verification

Proof of Income

Proof of Income

According to statistics by the National Association of Realtors® (NAR), 88% of homebuyers finance their home purchase through a mortgage or a home loan. Qualifying for a mortgage can be a tedious process and requires a lot of documentation.

Due to the substantial money borrowed, most money lenders have strict requirements to guarantee that you have sufficient funds to ensure monthly mortgage payments. While this process seems taxing, it is worth all the pain since you do not end up with an unattainable payment at the end of each month.

This article will guide you through the following main topics:

- Proof of Income for Home Loans

- Eligibility Income Criteria Required for a Mortgage

- How Much Income Do You Need to Buy a Home?

- What Are the Requirements of a Home Loan?

- What Should Be an Optimum Size of Down Payment?

- Proof of Income Requirements for Mortgage Loans

- Process of Getting Mortgage Approval

- No-Income Verification Mortgage

- Conclusion

Proof of Income for Home Loans

The proof of income isn’t as simple as handing over your recent pay stubs. It’s much more complicated than that. The mortgage lender needs to ascertain your ability to repay the loan. Therefore, they will require several documents to confirm that your income is as stated. For someone with traditional employment with a W-2 form, the process is straightforward. But, first, you’ll have to provide the following documents to prove that you have enough income:

- Pay stubs of at least two years

- Tax returns for two years

- W-2 forms – most recent

Lenders do not require you to be in the same job for two years; however, they’d prefer that you remain in the field. If you recently changed jobs, they may also ask for proof of income from your employer.

The lender will obtain the federal tax returns directly from the IRS, for which you’ll have to provide a signed form 4056-T. It authorizes the IRS to release them to your lender. Keep in mind that your application may be rejected if you have made a significant job change recently within two years. For someone relying on bonuses and commissions for their income, lenders generally require at least two years of bonus and commission income. For calculation purposes, they take an average of both years. However, if the income in the current year is lower, the lenders tend to use the lower number.

Proof of Income for Self-Employed People

The process is more complicated for people in self-employment. Tax returns are the primary means of verification of income for the self-employed. Mortgage lenders expect at least two years of income from your business and also tax returns. In addition to that, you may also be asked to provide profit-loss statements or bank statements for the past two years to ensure that the stated income hasn’t changed. It’s important to note that, for self-employed, the lenders are looking for the adjusted gross income (AGI) on your Schedule C. AGI is the business income minus any expenses and deductions.

Do I Have to Own a Business to Be Self-Employed?

You do not have to own a business to be self-employed. A mortgage lender considers the following people also to be self-employed:

You do not have to own a business to be self-employed. A mortgage lender considers the following people also to be self-employed:

- You do not receive W-2 tax forms rather 1099 tax forms.

- Contractor or freelancer

- You own 25% or more of a business

- 25% of your income is from self-employment

- A good portion of your income is from dividends and interests.

Eligibility Income Criteria Required for a Mortgage

Most mortgage lenders have a different definition of what’s affordable than borrowers. That’s because they want to make sure that you can repay the loan. And as such, they do not prefer you spending more than 36% of your pre-tax income on debt payments. If you have excellent credit, the number can go higher than 41%.

To calculate the minimum income needed to qualify for a loan, the lender adds the monthly mortgage payment, minimum monthly payment for credit cards, any other loans (i.e. car loan), child alimony, child support, etc. They then compare it with your monthly income. The resulting total debt payments should be less than 36% of your pre-tax income.

How Much Income Do You Need to Buy a Home?

Proof of income is one of the most important factors when it comes to a mortgage loan. However, there’s no minimum income you’ll need to buy a home. Instead of minimum income, lenders look at the Debt-to-Income (DTI) ratio. It shows the percentage of the gross monthly income that goes towards debt obligations. The DTI may vary depending on the different loans, conventional, FHA, VA, and USDA.

Generally speaking, your monthly payments should not be more than 30% of your gross income.

An adequate DTI for a home purchase depends on other factors, including the credit score. Most lenders require a DTI of at least 45%, while others allow as high as 50%, provided you have good credit and supplementary cash reserves.

What Are the Requirements of a Home Loan?

In addition to proving their income and employment history, borrowers also need to meet the standard loan requirements. Along with your finances, the type of property and the intended use also play an essential part in the home loans you qualify for. While the guidelines may vary depending on the different types of loan options, you can expect most lenders to follow the following criteria.

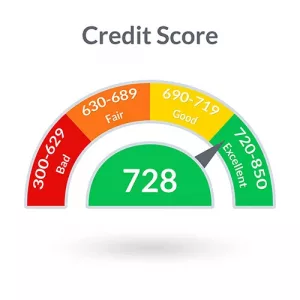

Credit Score

The credit score is a numerical rating that tells the lenders how responsible you are with your money. A conventional mortgage has a different credit requirement than other government-backed loans. Generally, the lenders expect a credit score of 620 or higher for better mortgage rates.

A high score can get you a low interest rate, while a low score can result in higher rates.

In the latter case, it’s also possible you’ll have trouble qualifying for a loan. Here are the minimum credit score requirements for various government-backed loans.

- Conventional Loans – 620

- FHA Loans – 580

- VA Loans – 580

- USDA Loans – 640

If you have a low credit score, you probably miss payments and regularly overdraft on your accounts. If your credit score isn’t where it is supposed to be, here are a few things you can do to increase it over time.

- Pay off debt – Determine any outstanding debt payments, pay them until it paid in full. With the reducing debts, the lender may even approve your mortgage.

- Make all payments on time – Making your monthly payments on time can help increase your score since 35% of the credit score comes from your credit history.

- Avoid closing credit lines – Neither close an existing credit line nor open new credit when buying a home.

Credit History

For an accurate report, lenders may pull the credit report (with your permission, of course). According to Bruce Ailion, a real estate agent in Atlanta, you may need to explain any shortcomings on your credit report, including a short sale or a foreclosure. In addition, you may have to write a statement explaining the lapses in your report. It helps the lender to evaluate the risk. They may even let it go if it’s a one-time unavoidable circumstance.

Assets

Your lender may also ask to see your assets while assessing the risk factors. Generally, they look for assets and bank accounts that can pay your mortgage payments when you run into any financial trouble. Assets are things you own that hold a significant value.

- Checking and savings account

- Stocks, bonds, and mutual funds

- Certificates of deposit (CDs)

- IRAs, 401(k)s or other retirement accounts

Lenders typically request the documents for verification to confirm the sources.

What Should Be an Optimum Size of Down Payment?

A down payment is the amount of mortgage the borrower lays down at the time of closing. Generally, it is 20% of the loan amount. Any amount less than that, you’ll have to buy private mortgage insurance (PMI). However, it is not the minimum you need to qualify for a loan. How much money you put down depends on you. Nevertheless, lenders have a minimum limit for the down payment, which you’ll have to meet.

- Conventional Loan – 3%

- FHA Loan – 3.5%

- VA/USDA Loan – 0%

Proof of Income Requirements for Mortgage Loans

Your income is not as much as a point of consideration when obtaining a loan. The most crucial part is your ability to make monthly mortgage payments. Other factors they’ll consider are the credit score, DTI ratio, and down payment. Each lender determines its qualifying criteria. Here’s a look into what lenders expect from borrowers:

Monthly Income

If you are on a payroll, the mortgage process is pretty straightforward. You’ll have to submit your recent pay stubs and W-2’s. If self-employed, you’ll have to submit your tax returns and other documents that the mortgage lender requests. The longer you stay in a position, the more the lender will be ready to loan you. In case you moved roles, you may want to wait a year or two before applying for a mortgage. Some of the other sources of income include:

- Overtime

- Commissions

- Alimony payments

- Military benefits and allowances

- Social security income

- Child support payments

- Investment income

Debt-to-Income (DTI) Ratio

Mortgage lenders use the Debt-to-Income (DTI) ratio to decide how much you qualify for.

DTI = Monthly Debt Payments ÷ Monthly Household Income

With the DTI ratio, the lenders determine if you can comfortably afford another debt. A low DTI is ideal, with lenders preferring 50% or lesser. Any more than that, chances are that your mortgage application will be rejected. If you have a high DTI, look for ways to cut back on your monthly budget or increase your income.

Asset Statements

Asset statements are proof of your net worth, including investments, bank statements, and assets, providing a detailed look at your finances. The comprehensive portfolio of assets ensures that you can comfortably afford the mortgage. Furthermore, it also helps the lender determine that the approved mortgage is the right one for your financial needs. When you apply for a mortgage, your lender requires records verifying the assets and the source of your wealth. In order to confirm the assets, you’ll submit asset statements detailing your portfolio to the lender. Here are some of the types of assets that need to be submitted in the verification:

Liquid Assets

Assets that have a cash value or can be converted to cash are called liquid assets. Lenders would want to verify that you have the means to pay the payments, insurance, taxes, and interest on your mortgage. The capability to pay for these is determined by the liquid assets, including bank account, savings account, checking account, stock option, etc. Experts suggest having six months of current income in liquid assets or cash to tide you over in times of financial emergency. This ensures that you can continue paying the mortgage payments even if you have no source of income.

Assets that have a cash value or can be converted to cash are called liquid assets. Lenders would want to verify that you have the means to pay the payments, insurance, taxes, and interest on your mortgage. The capability to pay for these is determined by the liquid assets, including bank account, savings account, checking account, stock option, etc. Experts suggest having six months of current income in liquid assets or cash to tide you over in times of financial emergency. This ensures that you can continue paying the mortgage payments even if you have no source of income.

Non-Liquid Assets

In addition to the liquid assets, lenders also expect proof of non-liquid assets in the asset statement. Non-liquid assets refer to difficult assets that take longer to convert to cash, including cars, jewelry, self-owned businesses, real estate, artwork, antique furniture, real estate property, etc. They may also change in value from the time it was initially purchased. While non-liquid assets may be difficult to convert in times of emergency, they are still valuable to lenders.

Gift Funds

If you receive money from friends and family to be put toward down payment or closing costs, it is also an asset in the eyes of the lender. Hence you need to verify the source during verification. To use the money safely without it affecting the mortgage approval process, ensure that you have the bank statement showing the deposit and also the bank statement from the giftee as a legitimate source of funds.

Process of Getting Mortgage Approval

The mortgage approval process is one of the most daunting yet vital steps before a home purchase. The process is long and can take anywhere from several weeks to several months.

Preapproval

Most borrowers prefer to get preapproved before starting the house hunt. Preapproval gives an idea of how much money you can expect from your lender and enables them to place a competitive bid. Even real estate agents and sellers prefer preapproved buyers.

Application

Once you have found your dream home, placed a bid, and your offer has been accepted, you can apply for a mortgage. At this juncture, the mortgage lender will check your credit report, income, assets, bank statement, debts, and other financial aspects.

Income Verification

The lender then does the income verification, where he confirms your income and ability to make monthly payments. Having all your documents ready and organized increases your chances of getting approved. The documents vary depending on your employment situation and may include pay stubs, W-2 forms, tax returns, profit/loss statements, and bank statements.

Do not make any cash deposits in your account before and during the mortgage process. You should deposit any cash intended for a down payment way before demonstrating your ability to save money. This is also counted as a part of your assets and should be verifiable.

Appraisal

Another factor that determines the loan amount is the appraisal. The lender conducts an independent appraisal of the property before approving the mortgage. The loan amount usually depends on this appraisal.

Title Search and Insurance

Title Search and Insurance

Before the mortgage is approved, the lender does a property title search and title insurance through a title company. This is to ensure that no other company or individual has rights or legal claims on the house.

Decision

With all the information in hand, the lender will approve or deny your loan. If they are unable to verify the financial information at hand, they may also suspend your application.

No-Income Verification Mortgage

No-income verification mortgages, otherwise called stated-income mortgages, use non-standard means of income documentation. They do not require borrowers to prove a source of income. The mortgage is ideal for self-employed people and seasonal employees. You can use available assets, home equity, and cash flow. There are four types of no-income verification mortgage:

- SISA – Stated Income, Stated Assets

- SIVA – Stated Income, Verified Assets

- NIVA – No-Income Verification, Verified Assets

- NINA – No-Income Verification, No-Asset Verification

Each of the loans mentioned above has different requirements. However, keep in mind that these should not be used to hide an insufficient financial standing. Apply for a no-income mortgage only if you can make the payments.

Conclusion

Verifying your income is the most critical part of the mortgage approval process. Having a verified proof of income ensures that you have the finances and assets needed in order to qualify for your home mortgage application. When you apply for a mortgage, lenders want to make sure that you have the capacity to make on-time payments every month without fail. Therefore, they have strict requirements for a borrower, including employment history and proof of income. The best advice experts have for you is to seek a professional like a mortgage broker who can guide you through the process. In addition, they can help you find a trustworthy real estate agent and a mortgage lender.

The people at Altitude Home Loans bring many decades of experience in doing loans the right way. If you are interested in purchasing a home, contact one of our Loan Officers today and we’ll guide you through the Home Loan application process. You’ll be glad you did.

The people at Altitude Home Loans bring many decades of experience in doing loans the right way. If you are interested in purchasing a home, contact one of our Loan Officers today and we’ll guide you through the Home Loan application process. You’ll be glad you did.