Buying a house is the first half of the battle. The second and the most important one is to choose a mortgage and a lender. Lenders are financial institutions or banks that facilitate home loans. Since you are likely to be paying off your mortgage for the next few years, it’s in your best interest to establish a working relationship with your lender. The right mortgage questions can help you navigate the process easier and obtain valuable information.

Our article brings to you the important questions to ask mortgage lenders, tips to help choose the best lender, and much more.

Essential Questions to Ask Your Mortgage Lender

Acquiring a mortgage can be a stressful and pretty complicated process, not to mention competitive. To make everything easier, here are a few questions you may want to ask your mortgage lender:

Acquiring a mortgage can be a stressful and pretty complicated process, not to mention competitive. To make everything easier, here are a few questions you may want to ask your mortgage lender:

The mortgage you can borrow depends on many factors including your income, credit history, and employment status, among others. Apart from that, there are special government programs you may be eligible for, i.e., veterans and first-time homebuyers, where you may be able to borrow much more than conventional loans.

- What are the interest rate and the annual percentage rate?

Be sure to ask him about the interest rate as well as the corresponding annual percentage rate APR (Annual Percentage Rate). The latter counts for loan-related charges and the fees but not the early payoffs.

- Which type of loan is the best for me?

Get your lender to explain the different loan options, including adjustable-rate loans, fixed-rate loans, interest-only loans, etc. Do not shy away from asking your lender about the pros and cons of each loan.

- How many discount points does the loan include?

Discount points are essentially fees paid to the lender to bring down the interest rate. Every point equates to 1% of the loan amount. Check if discount points are included in the quoted rate and the benefits of buying more points.

- What are the closing costs?

Closing costs makeup to 3-5% of the loan amount and include appraisal fees, attorney fees, origination fees, etc. Make sure that your lender provides you with a loan estimate covering the above.

- Any other fees and costs I need to know about?

The lender should provide you with a closing disclosure containing other expenses and costs associated with the loan.

- Can you guarantee on-time closing?

If, your lender cannot close within the said period, do they accept the additional expenses incurred?

Things to Look for in Choosing a Mortgage Lender

First and foremost, do not hesitate to shop around. Find a lender who not only gets you the best interest rate but also involves themselves in the process.

Here are a few tips to help you select the right lender:

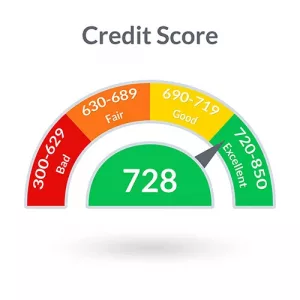

- Strengthen your credit score. Higher the score, the better bargaining power you have.

- Get preapproved with a few lenders to increase your chances of having your offer accepted.

- Compare the mortgage rates, down payment requirements, insurance, fees, etc., and select the one that works to your advantage.

- Understand the major players in the field. You can choose between credit union companies, mortgage bankers, savings and loans, mutual savings banks, and correspondent lenders.

- Ensure that your lender is registered in the state you reside.

- Narrow down your choice by reading reviews and complaints online.

- Always read the fine print on the loan documents. They reveal what the lenders do not say outright.

Things That Get Your Loan Application Denied

While it is essential, to be honest with your lender, the wrong information can get your mortgage application denied. Here are a few things you dare not reveal:

- Lying on your loan application is a felony; It can reduce your chances of approval.

- Not paying the bills on time; Inconsistency is a prime concern, and missed bill payments are red flags.

- Maxed out cards; Lenders may run a final check, and any new debts can cause them to deny the application or change the terms.

- Never apply for new cards or credit lines when you are about to finalize your loan.

- Lenders would like you to have stable employment for at least two years. Repeated job changes are another red flag.

- While a lateral move or a promotion may not make significant changes, going to a commissioned work can be the reason your application is denied.

- You should have finalized the details of the down payment before seeking a home loan. If you haven’t so far, it could lead to your application getting denied.

- Make sure your lender knows if the initial down payment is a gift. The donor should be an immediate family member, and you should be able to furnish paper trails.

- Do not ask about foreclosure in the initial signing process.

- Do not ask them for information about credit scores. Monitoring your credit score should be a part of your financial routine by now.

Types of Mortgage and Mortgage Loans

A mortgage is a loan that a borrower uses to buy real estate like a home or other property. The property itself acts as collateral for the loan. The loan is then repaid over a period of time in a series of monthly mortgage payments.

A mortgage is a loan that a borrower uses to buy real estate like a home or other property. The property itself acts as collateral for the loan. The loan is then repaid over a period of time in a series of monthly mortgage payments.

Mortgages can be:

Fixed-Rate Mortgage is a home loan paid over a fixed period with a fixed interest rate no matter the changes and trends.

Adjustable-Rate Mortgage is where the interest rate is fixed initially but later on increases over the life of the loan depending on the market.

Interest-only Mortgage involves complex repayment schedules and is only used by sophisticated and experienced borrowers.

FHA Loans are insured by the government through the Federal Housing Administration (FHA). They are a good choice for first-time buyers since they have incentives like low or no down payment, low credit score, etc.

VA Loans is issued for US veterans and spouses of deceased veterans. Most often, these loans do not require any down payment.

Mortgage Lender Questions for Home Buyers

Consumer Financial Protection Bureau reports that most homebuyers do not put as much thought into a mortgage as they do with homes. Only when you look around and ask your lender relevant questions is when you get a reasonable mortgage rate.

- What are the different mortgages you offer?

There are quite a few different types of loans available for home buyers. Of these, the most common one is the conventional loan. Then, there are government-insured loans such as the VA loans and FHA loans. Talk with your mortgage lender and choose the right type of mortgage for your financial situation.

- Are there any down payment assistance programs?

Down payment assistance programs are offered by local, federal, and government agencies to help cover the down payment and closing costs in some cases. Make sure that your mortgage lender works with the program of your choice.

- Is there a prepayment penalty?

Lenders charge a prepayment penalty in case you pay the loans early to make up for the lost interest.

- What is the minimum down payment?

The usual down payment is 20%, with most loans. Few lenders allow you to go as low as 3% if you are qualified, but you may have to pay for private mortgage insurance and increased closing costs. Moreover, with a 20% down payment, the lender may lower your interest rate.

- Can I get a rate lock on the interest rate?

With fluctuating interest rates, it is better to have a rate lock if possible. Lenders usually charge 1 point. But, beforehand, enquire about the fees, lock-in period, etc. Also, ensure that you have it in writing.

- What about the origination fees?

Origination fees are upfront fees charged by the lender for processing the mortgage loan application. It can be anywhere from .5%-1% of the loan amount.

- How long do you need to process the loan?

A lot of factors affect the processing time but a rough idea of the time helps you plan. The average closing time is 43 days.

Reasons to Talk to a Mortgage Lender Before House Hunting

If you are keen on buying a home, it makes sense to start with your mortgage lender before contacting a realtor. This helps you understand your financial situation with all the available options in front of you.

Some of the reasons why you would want to talk to a lender first hand:

- It helps to set realistic expectations when buying a new home. If nothing, get a preapproval letter in the least. It makes you attractive to sellers and real estate agents.

- You can still shop around with a preapproval letter. But, the catch here is that your credit score gets dinged every time someone pulls your credit report. However, if all your inquiries are within a set period, say 2 weeks, it is considered one inquiry and doesn’t affect your score as much.

- A pre-approved mortgage loan offer attracts sellers and real estate agents since it proves that you are serious about buying and not just looking around.

- Starting the mortgage application process earlier makes it easier to complete it on time.

Questions to Ask Your Lender Before Closing Your First Home Mortgage

Being prepared comes in handy especially when it comes to the first home mortgage. Here are some questions you may want to ask your mortgage lender before closing:

- How much is the monthly payment?

Make sure you can afford the monthly mortgage payment especially if you are paying rent at the same time.

Not down the due date for every month and also the grace period if any.

Your payments do not change unless you have an ARM or if your insurance or taxes change. But, it doesn’t hurt to ask.

- Does the seller bear any of the fees?

Depending on the deal, some of the closing costs may be borne by the seller. Your lender should be able to guide you in this regard.

Ensure that you are setting aside enough sum to cover the insurance and the property taxes every year.

- What is the appraised value of my house?

Knowing this figure can help you if you are planning on selling your house in the coming years.

- Do I require mortgage insurance?

In general, your mortgage insurance can be waived when you owe less than 80% of the mortgage. Consult with your lender about when and how to get it removed.

Questions to Ask When Getting a Home Loan

There’s a lot more you need to consider than the mortgage rate when getting a home loan. The following questions can help you with the important questions you may want to ask your lender.

There’s a lot more you need to consider than the mortgage rate when getting a home loan. The following questions can help you with the important questions you may want to ask your lender.

- What home loans do I qualify for?

Not all lenders offer the loans you qualify for. So, it pays to do a little research on your own firsthand.

- What’s the best rate you can offer me?

Though interest rates depend on the loan-to-value ratio, it doesn’t hurt to negotiate. The higher the down payment, the better your interest would be.

- Give me a brief about the loan estimate document.

The loan estimate document covers the pertinent information including interest rate, monthly payments, closing costs, etc. Walkthrough the document so that you are clear on the terms and conditions.

- Do you charge for rate lock?

While most lenders offer a rate lock for 30-60 days for free, not all do that while others charge for an extended lock period.

- Do you have any loan programs where I can avoid paying mortgage insurance?

Many lenders offer non-private mortgage insurance loans even if the down payment is less than 20%.

- What documents do I need to provide?

The quicker you had over the necessary documents, the faster the loan process time would be. So, it pays to enquire about the documents in the beginning and have them ready.

Mortgage Questions to ask During a Refinance

Refinancing your mortgage has many benefits such as lower interest rates, less monthly payment, reducing your terms, and many more. However, before refinancing you may want to ask your lender the following questions.

- What interest rate do you offer for a no-cost refinance?

Be sure to ask your lender about the interest rates for no-cost refinancing loans. While lenders advertise their lowest rates, it might not be the one for you.

Make sure the rates they quote are based on your refinancing situation and financial needs.

- Do I qualify for a refinance?

While every lender has their own qualifications, here are some common factors, that remain the same for everyone: Credit score, debt-to-income ratio, and home equity.

- What refinancing options do you offer?

The most common refinancing options available are rate and term refinance and cash-out refinance. Ensure that you ask your lender about the various options as well as the benefits and drawbacks of every option.

- How does this affect my monthly payment?

Depending on the type of refinance you choose, the payment can either increase or decrease. In the case of the latter, even though the payment is less, you’ll be paying more towards the interest than the loan itself. For the former, you’ll be paying more towards the loan and own your house quite soon.

Chances are that your lender will sell your loan to maintain a cash flow. Few other lenders on the other hand do the servicing in-house even if the mortgage is sold.

- How much equity can I cash out?

You cannot cash out more than 80% of your equity with the exception being the VA loan where you can take 100% of the equity.

Questions to Expect from Mortgage Lenders

Here are a few questions your mortgage lender may ask you prior to your application.

They might go into detail about the history including how you pay your cards i.e, minimum balance, or full payments. You may also have to disclose co-signed loans, income taxes, property taxes, bankruptcies, support payments, etc.

Ensure that you disclose all your sources of income. They may also inquire about your past and current jobs including the job stability in the recent past. In the case of self-employment, you may also have to explain your business setup.

- Property purchase or refinancing

If you are refinancing, you may have to give details about your property including the type of property(rental or owner-occupied), improvements if any, known damages, potential hazards, etc.

By disclosing your future plans, you let them know about your ability to make mortgage payments. So, you may want to reveal information about any apparent job changes.

- Your expectations from mortgage loans

You may want to be upright about how much you would like to put down for a monthly payment and prepayment penalties if any. Finally, your lender would want to pay off the loan quickly or just make the lowest payment.

Questions Mortgage Lenders Can’t Ask

Even though it looks like a lender can ask any question, they cannot ask anything that is discriminating based on race, religion, color, sex, age, marital status, etc.

Even though it looks like a lender can ask any question, they cannot ask anything that is discriminating based on race, religion, color, sex, age, marital status, etc.

Who’s Better: Mortgage Lender or Bank?

There aren’t as many differences between banks and mortgage lenders. They both fund the loans directly. But a lender, on the other hand, doesn’t offer financial services like cards, savings accounts, etc.

On the bright side, the lenders are not as conservative as the banks and are more flexible. Hence they accept low credits, down payments, and interest rates.

Factors That Disqualify You for Mortgage Loans

As of July 2012, the financial institutions tightened the procedure and hence the following factors can get you disqualified for a loan.

- Too low credit scores; Be it a medical issue or an inability to pay, it’s all the same for a lender. Since this defines your ability to pay back loans, low scores are not appreciated.

- Lack of proper employment or steady employment; You need to have 2 years of steady and continued employment before being considered for a home loan.

- Inadequate monthly income; Even if you have a steady income, the lender may not approve owing to insufficient funds.

- Too much debt; A debt ratio of 36%-38% will disqualify you for a loan.

Conclusion

Buying a home is a complex and stressful process. Asking your questions ahead of time can help make it easier to choose the appropriate lender.

Make sure you ask a lot of questions about income requirements, down payments, types of loans you qualify for, prepayment penalties, etc. There are no right or wrong questions. Walkthrough the finer details and make sure to get all your “t’s” crossed and “i’s” dotted. Whatever type of loan you apply for, ensure that you read the terms of the agreement carefully before signing up. Take your time to understand the risks and weigh the pros and cons before proceeding.

The people at Altitude Home Loans bring many decades of experience in doing loans the right way. If you are interested in purchasing a home, contact one of our Loan Officers today and we’ll guide you through the Home Loan application process. You’ll be glad you did.

Proof of Income

Proof of Income You do not have to own a business to be self-employed. A mortgage lender considers the following people also to be

You do not have to own a business to be self-employed. A mortgage lender considers the following people also to be

Assets that have a cash value or can be converted to cash are called liquid assets. Lenders would want to verify that you have the means to pay the payments, insurance, taxes, and interest on your mortgage. The capability to pay for these is determined by the liquid assets, including bank account, savings account, checking account, stock option, etc. Experts suggest having six months of current income in liquid assets or cash to tide you over in times of financial emergency. This ensures that you can continue paying the mortgage payments even if you have no source of income.

Assets that have a cash value or can be converted to cash are called liquid assets. Lenders would want to verify that you have the means to pay the payments, insurance, taxes, and interest on your mortgage. The capability to pay for these is determined by the liquid assets, including bank account, savings account, checking account, stock option, etc. Experts suggest having six months of current income in liquid assets or cash to tide you over in times of financial emergency. This ensures that you can continue paying the mortgage payments even if you have no source of income. Title Search and Insurance

Title Search and Insurance The people at

The people at

Acquiring a mortgage can be a stressful and pretty complicated process, not to mention competitive. To make everything easier, here are a few

Acquiring a mortgage can be a stressful and pretty complicated process, not to mention competitive. To make everything easier, here are a few  A mortgage is a loan that a borrower uses to buy real estate like a home or other property. The property itself acts as collateral for the loan. The loan is then repaid over a period of time in a series of monthly mortgage payments.

A mortgage is a loan that a borrower uses to buy real estate like a home or other property. The property itself acts as collateral for the loan. The loan is then repaid over a period of time in a series of monthly mortgage payments. There’s a lot more you need to consider than the mortgage rate when getting a home loan. The following questions can help you with the important questions you may want to ask your lender.

There’s a lot more you need to consider than the mortgage rate when getting a home loan. The following questions can help you with the important questions you may want to ask your lender. Even though it looks like a lender can ask any

Even though it looks like a lender can ask any