Did you know that the usable home equity in the US totals 5.5 trillion dollars? And somewhat surprisingly, it has continuously grown throughout 2020 and beyond despite the advent of a worldwide pandemic. Here is a guide to home equity loans that let you know everything you want.

You know all about the first mortgage which you used to purchase your home. But are you aware that you can take an additional loan on your home?

This article takes you through everything you need to know about a home equity loan, how to calculate home equity, equity lines of credit, and much more.

What is a Home Equity Loan?

A home equity loan is a loan that is obtained by using your home as collateral. Just like your mortgage, you pay it back in fixed monthly payments for the life of the loan. If you don’t pay it back, the lender can foreclose your home as payment, and you could lose your home.

This kind of loan is dependent on the:

- Current market value

- Mortgage balance

How Does Home Equity Loan Work?

Sometimes called a second mortgage, a home equity loan allows a homeowner to borrow a lump sum amount against the equity. Equity is the difference between the current market value and the outstanding mortgage. The interest rate depends on the payment history and credit.

Once approved, the lender and the borrower agree on a set payment term. The borrower then makes monthly payments covering both the interest and the principal.

To start with, you might decide to contact a credit counselor to determine your creditworthiness and to find out how much your home is worth.

Is it a Good Idea to Do a Home Equity Loan?

A home equity loan is a good idea if:

- You use the funds to make a home improvement that increases your home’s future value.

- You cover your debt with a low fixed interest rate.

- You have investment plans with guaranteed returns.

However, it’s usually a bad idea to secure a home equity loan to:

- Shift your debt around

- Purchase a new car

- Pay for vacation

If you cannot pay for the above with your monthly budget, you cannot afford to borrow money on loans either.

How Much Can You Borrow on a Home Equity Loan?

The amount you can borrow really depends on how much difference there is between the value of your home and your current principal balance. Usually a loan of this type requires a minimum home equity of 20% or more to borrow. Additionally, most lenders allow you to borrow a lump sum of only up to 85% of the home equity.

To calculate the eligible loan amount, the lender divides the amount you owe on your mortgage by your home’s current value. It’s called the loan to value ratio, or LTV. The LTV should be 80% or less, which means that your equity would be 20% or more.

Shop around for a lender who gives you both a better fixed rate and higher LTV.

What Documents Do I Need for a Home Equity Loan?

With appropriate documentation, a home equity loan is a pretty easy and straightforward process. Here’s what most lenders will require to give you a loan.

- W2 earnings statements or 1099 DIV income statements (for the previous two years)

- Federal tax returns (for the previous two years)

- Paycheck stubs for the past few months

- Recent bank statements

- Proof of investment income

- Proof of additional income

Depending on your lender, you may need other documentation not listed here, but having these in hand can speed up the process.

Can You Get a Home Equity Loan at Any Time?

Generally, the answer is yes! You can get a home equity loan at any time, but only once. You can’t take out another mortgage before closing out the others.

When you take a loan, you get a lump sum amount of money upfront. You can then repay it over time as previously agreed upon.

It should have a fixed interest rate which would remain the same throughout the loan term.

Are Home Equity Loans Available to Rental Property?

Yes! If you are a rental property owner, you can get a loan provided you qualify. Though you can obtain up to 100% LTV, lenders restrict the loan to 65% – 80% on a rental property.

Everything else is basically the same as for a primary residence.

When Should You Refinance a Home Equity Loan?

Refinancing a loan is ideal if you are looking for different loan terms or to refinance your mortgage for a lower interest rate.

You can refinance a loan when you:

- Secured your first and second mortgage when the interest rates were high

- Have a good amount of equity

- Can afford the monthly payments

- Plan to sell your home within few years

- Save overall costs

What Is the Downside of a Home Equity Loan?

Any loan that uses your primary residence as collateral should be considered very carefully, so it’s a good idea to weigh the pros and cons before you apply for a home equity loan.

The downsides of home equity loans should also be taken into consideration.

- A home equity loan requires you to use your home as collateral.

- If you default on the loan, the lender can repossess your property, and you may end up losing your home.

- If you are still paying your first mortgage, a second loan can be a financial burden.

- There will likely be closing costs.

- You can’t get a loan with poor credit.

How Much Equity Do I Have on My House?

Equity is the difference between your mortgage balance and your home’s value. Your equity increases when:

- you pay down your mortgage

- the value of your house increases

Your equity can also fall if the house falls in value faster than the rate at which you pay your mortgage.

Here’s an example to explain the above:

Imagine you buy a house for $200,000 with a down payment of $20,000. Your mortgage loan would be for the $180,000 remaining, and your equity would be about $20,000.

In about two years, your principal would be reduced down to $170,000 thanks to your timely payments (minus interest), but the value of your home shrinks down to $160,000. In this case, the equity in your home would be -$10,000 since your home has actually decreased in value.

However, if you build or substantially improve your home, the equity should increase in value over the years.

How Do I Use the Equity in My Home?

You have three ways by which you can use the equity in your home:

- a home equity loan

- a line of credit

- a cash-out refinance

A home equity loan is usually a smart way to secure a loan and receive a lump sum. These loans almost always have lower interest rates than a personal loan. Your choice, however, depends on your need and also the situation. Contact your credit counselor to check if you have enough equity in your home to apply for a loan.

How Soon Can You Access Equity?

As early as six months after the purchase of your home, you may request a revaluation. A few lenders may require you to wait up to one year for access. Regardless of the required time limit, you should try to wait until you determine how much equity you have before you use your home to back the loan.

What Can A Home Equity Loan Be Used for?

There are few rules regarding what this type of loan can be used for. You can use it for:

- Home improvements like kitchen renovation, a new roof, a garage, or building a patio

- Funding college education for your kids (due to the lower rate of interest than student loans)

- Manage emergency expenses

- Cover wedding expenses

- Consolidate your debts to a low-interest rate

- Investment opportunities like a second residence or share market

- Funding your business (if the interest rates are lower than comparable small business loans)

But it is safer to use the money for home improvement since it that’s what will increase your home’s value.

Can You Use Home Equity to Pay Off Debt?

Yes! You can take out a home equity loan to pay off debts, especially high-interest or unsecured debt. Some homeowners use it to pay off credit cards or car loans. The downside is that your debt is now secured by your home.

Can I Use a Home Equity Loan to Buy Another House?

Yes! You can use the money to finance another house. But ensure it is an investment property and that you can make the monthly payments.

Using a home equity loan to buy another house allows you to:

- Retain your existing investments

- Get a lower rate of interest

- Access a part of your net worth that would otherwise be inaccessible

When you use it as a down payment, it enables you to increase the cash flow from your new house. However, you would also run greater risk if real estate values go down instead of up.

What is the Closing Cost for Home Equity Loans?

The closing costs can range anywhere from 2% to 5%.

A few lenders may waive closing costs occasionally, but you might have to pay certain offsetting fees, as well as being expected to close the loan in a specific time period, generally three years.

- Appraisal fee – $300-$700

- Notary fee – $50 – $200 for every signature

- Credit report fee – $30 – $50

- Title search – $75 – $100

- Attorney fees – Varies

Can Home Equity Loans Be Paid Off Early?

Yes! You can pay back your loan early, provided that you are prepared to pay any prepayment penalties.

Some lenders may charge you a fee if you pay back the loan in less than five years. Make sure you read the loan agreement carefully before making a decision.

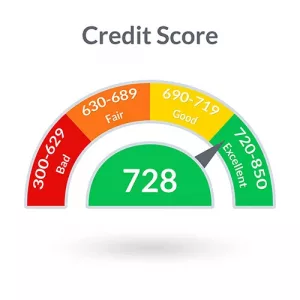

Do Home Equity Loans Hurt Your Credit Score?

It’s true that some home equity loans may lower your score or hurt your credit, depending on your:

- Financial situation

- Ability to repay

Also, if you have a high credit utilization rate, your score may decrease. On the other hand, if you open a line but don’t use a lot of it, your score will probably increase.

Requirements to get the loan you are looking for

The requirements to get a home equity loan are:

- Your credit score should generally be upwards of 700. Some lenders may accept scores between 621-700 too.

- You should have enough equity in your home (at least 15%-20%)

- Your debt to income ratio should be 43% or lower.

- You need to have a good payment history.

- Your income is sufficient to be a good credit.

What Credit Score Is Needed for a Home Equity Loan?

A higher credit score correlates to a lower interest rate. Aim for a score of 740 or higher for an optimum interest rate. Still, some lenders accept scores as low as 660 or even 620, but your interest rate will definitely increase with lower scores.

Do You Need Homeowners Insurance to Get a Home Equity Loan?

Most loans require you to carry a homeowner’s insurance unless you either:

- Own your home outright

- Have an old mortgage

Banks demand insurance as a requirement for a loan, just in case the unthinkable happens. It’s a good idea to have a home insurance policy in place beforehand.

Why Would I Be Denied a Loan?

You can have a good credit score and still be rejected for a home equity loan. Banks are more concerned than ever about getting their money back.

If you were denied, it may be because:

- You accumulated unexpected debt

- You have unreliable income

- You filed for bankruptcy

Is the Interest on a Home Equity Loan Tax Deductible?

Interest on a loan is tax deductible only if:

- The loan is for your first or second home

- You use the loan to substantially improve the home

- It is a construction loan

- Both the lender and borrower enter an agreement to repay the loan

How Do I Get a Loan on a House That Is Paid for?

Homeowners with a paid-off house can secure loans the same way you would do with a mortgaged home.

A property that is already paid off is an excellent candidate for a loan due to the lack of liens. That means in the case of a foreclosure, no liens mean the loan is paid off first, which means a lower interest rate. However, this doesn’t necessarily guarantee a loan. Your payment capacity also comes into the picture. You may be able to borrow money only up to the max LTV of your lender.

What is a Home Equity Line of Credit?

A home equity line of credit or a HELOC closely resembles a credit card. You have a source of funds that you have access to when and as you choose. You can withdraw as little or as much as you’d like.

Much like a home equity loan, the rate of interest is much lower than the other loans.

Depending on the bank, you can access it via:

- a check

- an online transfer

- a credit card

In a way, they act as emergency funds that you can access any time you want.

How Does Equity Line of Credit Work?

With a HELOC, you borrow the equity in your home with it as collateral. As you use the lines of credit, you can repay by replenishing them like a credit card.

You can borrow as little as you want or as much as you’d like within your draw period. At the end of the draw period, you begin to repay it back.

A home equity line has a variable rate of interest, which differs from month to month. This is a marked difference from a fixed-rate second mortgage.

Home Equity Loan or Line of Credit

Both the loan and the equity lines of credit are taken against the home. While the loan gets you a lump sum, the home equity line acts more like a credit card. Like credit cards, you can access the money whenever the need arises.

The loan has fixed interest rates with payments in regular intervals. The credit lines have a variable interest and often do not have any fixed payment plan.

Apart from these, both function the same. Which you use, however, depends on your financial situation.

Home Equity Loans or Mortgage

The notable difference between a mortgage and a loan is the time of purchase. A home equity loan is taken on a home you already own, while a mortgage is a loan that allows you to purchase the home in the first place.

Both are lending tools that are taken against your house. Both have tax deductions of up to $750,000.

Lenders generally offer 80% of value as a loan. The rate of interest is sometimes lower on a home equity loan when compared to that of a mortgage.

Home Equity Loans vs. Personal Loans

Both the loans vary vastly, both in the interest rates and in the loan limits and eligibility. They have different pros and cons.

A home equity loan has a low rate of interest since it is secured using your home as collateral. It often offers a lower interest rate than a personal loan would.

Personal loans may take days to close and fund, but home equity loans can take over three weeks.

Conclusion

Home equity loans are loans based on the equity of the house as security. The loan amount is calculated based on what you owe on your mortgage and what your home is worth. This type of loan offers lower interest rates than personal loans. You’d have to make a monthly payment in addition to your mortgage.

While you can use the money for any purpose, it is generally safer to buy, build, or substantially improve your home, prioritizing spending that will increase the property’s value for years to come.

Home equity lines are loans that act similarly to credit cards. You can then use it as and when the need arises. The loan amount and interest depends on the lender.

Securing a loan (home equity or otherwise) can be a daunting task. But with the proper research and preparation, your efforts can meet with success.

Find out more on home equity loans

Yes!

Yes!  Lenders require you to have

Lenders require you to have

Buying a home is many American’s ideal goals, but the process involved in buying one is complex. Before purchasing a home, you need to make sure your credit and finances are in order. You’ll need to fill out different paperwork and submit various forms of verification before securing a home. Unless you plan on buying your home upfront, you’ll need to finance through a bank.

Buying a home is many American’s ideal goals, but the process involved in buying one is complex. Before purchasing a home, you need to make sure your credit and finances are in order. You’ll need to fill out different paperwork and submit various forms of verification before securing a home. Unless you plan on buying your home upfront, you’ll need to finance through a bank.