Cash-Out Refinance

Experts suggest that home prices are steadily climbing and could reach new heights in 2021, increasing by nearly 5.7%.

Experts suggest that home prices are steadily climbing and could reach new heights in 2021, increasing by nearly 5.7%.

Buying a home is a costly affair and a big investment for the ordinary person, such that you’d want to make the space warm, cozy, and comfortable. However, with the rising costs, you are neither left with money to make the necessary changes nor be able to save up for it.

With cash-out refinancing, you can renovate, remodel and update your home without having to resort to high-interest loans such as personal loans and credit cards. Apart from that, you can also negotiate the payment terms, get a lower interest rate, etc.

This article takes you through everything you need to know about cash-out refinancing, including reasons, pros, cons, closing, how cash-out refinance works, and many more.

Cash-Out Refinancing

A cash-out refinance is where you take a new loan with a higher loan amount than the current mortgage. The new loan replaces your existing mortgage, and the remaining amount is handed over to you minus the closing costs. The lump-sum you get is yours to do as you please.

The cash-out refi depends on the home’s value. Most lenders let you borrow 80%, while you can take the entire home equity in the case of VA loans.

Also, the higher loan amount may result in higher interest rates.

Calculate Cash-Out Refinance

Cash-out refinance lets you take advantage of the equity you’ve built on your home. For example, if your home is worth $200,000 and you have paid off $60,000. You still owe $140,000 as a mortgage balance.

Let’s say that you want to make $20,000 worth of renovations to your home; You can take a cash-out refinancing to fund your renovations.

The cash-out refinance replaces the original mortgage. So, your new mortgage would be:

$140,000 + $20,000 = $160,000

You would receive the remaining $20,000 a couple of days after closing.

How Does Cash-Out Refinancing Work?

The cash-out refinance works similarly to any other loan process. You (the borrower) start with finding a lender with better interest rates and payment plans, submitting an application, and documentation.

Here are the detailed steps your lender may take you through:

Meet the Requirements Set By Your Lender

The lender first sets their terms and conditions, upon the qualification of which you are eligible for a cash-out refinancing:

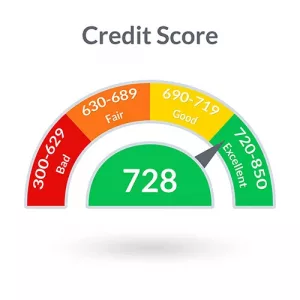

- You should have a credit score of at least 620.

- Your debt-to-income ratio should be less than 50%

- You should have at least 30% of the equity in your home.

- No late payments on your mortgage within the last 12 months.

- Refinance is available only for the primary residence.

Decide How Much Cash You Need

The next step is to determine how much capital you may need. If you are planning for renovations, it is a good idea to contact your contractor and get an estimate prior to the application.

For debt consolidation, sit with your bank statements, credit cards, etc., and work out how much cash you would need to cover your debts.

Complete the Application Process

To complete the application process, you may need to provide the following documentation:

- Bank statements

- W-2

- Pay Stubs

After you get the approval, the closing process starts. You may have to wait for a couple of days after closing to receive your lump sum.

Reasons to Consider a Cash-Out Refinance

A cash-out refinance provides better financial benefits than a personal loan or a second mortgage. Here are some of the reasons why you may want to consider a cash-out refinance:

- Funding renovations and home improvements

Constant upgrades and renovations are needed to maintain your home and also to increase the home’s value. From broken HVAC systems to kitchen remodeling, cash-out refinancing helps to use the home equity to fund your home improvements.

- Consolidate and pay your debt

With a refinance, you can opt to consolidate your debts for a lower interest rate and pay them off.

Personal loans and credit card debt can have a higher interest rate, while mortgage and refinancing generally have a lower interest rate. Hence it makes sense to pay off your credit card debt and personal loan using a cash-out refinance.

- Better investment opportunities

Refinancing may make sense to withdraw cash from refinancing for investment opportunities and retirement plans rather than having funds ties with your home. You can also use a cash-out refinancing towards financial needs such as college funds since the interest rate is lower.

Cash-Out Refinance: Pros and Cons

Cash-out refinancing provides you with a considerable amount of money when you require liquid cash and at a competitive interest rate. But the risk is real. Since you use your home equity to fund the refinancing, you run the risk of losing your home.

Hence it makes sense to evaluate the pros and cons:

Pros of a Cash-Out Refinance

Pros of a Cash-Out Refinance

- The equity in your home is worth a significant amount, and tapping gives you access to a lump sum of cash. You can use the money to either further your/your child’s education or maybe invest in a business with assured success.

- Mortgage rates are generally lower when compared to credit cards and personal loans since it is secured by your home.

- Increase the monthly payments by replacing the original loan with a new one.

- In case the cash is used to fund any substantial renovations that increase the home’s value.

Cons of a Cash-Out Refinance

- Restarting the monthly payment terms increases the interest costs. Dragging out the payment does not yield the savings you expect from paying off a lower interest loan.

- The loan is secured against your home. Failing to repay, you run the risk of losing your home. Do not withdraw more than you need.

- Withdrawing up to 90% of your home equity increases the borrowing costs since you have to bring it back to the 80% threshold.

- Mortgage loans have higher closing costs which run in hundreds to thousands of dollars. You can either pay them upfront or roll them into your loan amount.

- You tend to use it as your personal piggy bank for lavish vacations or purchases with access to home equity. Consider seeking help for your spending habits through a non-profit counseling agency.

To Cash-Out Refinance or Not

Cash-out refinance is a good idea if you require access to your home equity for home renovations or something that gives you a better return for your investment. It also gives you a chance to lower your mortgage rate if you are in the higher mortgage interest bracket.

However, it may be a bad idea to avail yourself of cash-out refinancing if you plan on using the money for a new car or vacation since they do not have little to no investment.

Closing on Your Mortgage Refinancing

The final step in cash-out refinancing is the closing, where you sign documents, pay the fees, and then walk away with a new loan (hopefully a better interest rate). The process itself may take up to a few hours in the least.

Three days before the closing process, you get the Closing Disclosure which contains

- Closing costs

- New Terms

- Monthly Payments

- Miscellaneous costs and credits

- Fees

The closing costs for a cash-out refinance would be 2% to 5% of the new mortgage, i.e., $4000-$10,000 for a $200,000 loan. You can either pay closing costs with a cashier’s check or roll them into your loan amount.

The closing costs may cover:

- Early repayment fees

- Discount points

- Origination fees

- Appraisal and inspection fees

- Mortgage and title insurance fees

Once everything is signed, the “Right of Rescission,” the three-day grace period for the borrower, starts. It may take 3 -4 days to complete the transaction and get cash.

On a side note, you would be required to read and sign a lot of documents, affidavits, and declarations. Make sure that you read them meticulously before signing as they are legally binding.

Which Is Better? – Cash-Out Refinance vs. Home Equity Line of Credit

Cash-out refinance and home equity line of credit both access your home’s equity and uses your home as collateral. But that is where the similarity ends.

Cash-out refinance and home equity line of credit both access your home’s equity and uses your home as collateral. But that is where the similarity ends.

Cash-out refinance settles the existing mortgage and kick starts a new mortgage with different terms and lower interest rates. It gives you a significant amount of liquid cash, which is yours to use as you wish. On the downside, they have high closing costs.

HELOC, on the other hand, is a new one in addition to your first mortgage loan. Considered to be a second mortgage, it has its payments and terms, which don’t influence the original loan in any way. Unlike refinancing, you get a line of credit from where you withdraw as you require. Home equity line of credit has very little to no closing costs.

Which Is Better? – Home Equity Loan vs. Cash-Out Refinance

Home equity loan and cash-out refinance lets you convert your home equity into cash. But both operate differently.

A home equity loan acts as a second mortgage and is secured against your home. The amount you get depends on the home’s equity. You will be responsible for the mortgage and also the new mortgage loan at the same time. With a home equity loan, the lender pays the closing costs.

With a cash-out refinance, you take out a new one to replace your mortgage loan with the home equity used to pay for the cash-out. It will have new terms, including a lower mortgage rate and more extended monthly payments.

The mortgage interest is lower for the cash-out, but the high closing costs more than makes up for it.

Conclusion

Cash-out refinance is the best option if you require a significant amount of liquid cash to pay off high-interest loans or home renovation. But the catch is that your home is used as collateral, and if you are unable to make payments, you may end up losing the home. And then there are the closing costs. But to your advantage, they also come with tax benefits. Your auditor should be able to guide you with these.

Tapping into your home equity is not a decision to be taken lightly. If you are not sure about cash-out refinancing, you may want to talk with your financial advisor or a home loan expert.

The people at Altitude Home Loans bring many decades of experience in doing loans the right way. If you are interested in purchasing a home, contact one of our Loan Officers today and we’ll help you through the Home Loan application process.

Other timely articles you may enjoy:

Yes!

Yes!  Lenders require you to have

Lenders require you to have

Experts

Experts Pros of a Cash-Out Refinance

Pros of a Cash-Out Refinance Cash-out refinance and home equity line of credit

Cash-out refinance and home equity line of credit

Refinancing your mortgage loan gives you the opportunity to reduce your monthly payments. But, there are several steps and processes you need to go through before you can finalize a mortgage refinancing. First, you need to determine how much equity you currently have in your home. Doing so enables you to determine if going through the refinancing process is something worth your time.

Refinancing your mortgage loan gives you the opportunity to reduce your monthly payments. But, there are several steps and processes you need to go through before you can finalize a mortgage refinancing. First, you need to determine how much equity you currently have in your home. Doing so enables you to determine if going through the refinancing process is something worth your time.