A Complete Guide to Refinancing Your Home

For the 8th straight week, home refinancing rates are below 3%. The low interest rates have increased the home equity in many markets. An average borrower gained $33,000 in home equity in the year 2021. Refinancing your home, when done right, can save you money in interest.

For the 8th straight week, home refinancing rates are below 3%. The low interest rates have increased the home equity in many markets. An average borrower gained $33,000 in home equity in the year 2021. Refinancing your home, when done right, can save you money in interest.

But what if you want to refinance your home multiple times. Does it work? How often can you refinance your home? This article will help answer these and many other questions as we cover the following main topics:

- What Does it Mean to Refinance Your Home?

- Is it Bad to Refinance Your Home Multiple Times?

- How Long Do You Have to Wait Between Refinancing?

- Does Refinancing Your Home Hurt Your Credit Score?

- Is it Worth Refinancing Your Home Now?

- Why Do Homeowners Refinance Multiple Times?

- How Often Can You Refinance Your Home Loan?

- What Is the Average Time to Refinance a Mortgage?

- How Much Money to Borrow When Refinancing Your Home

- Drawbacks of Refinancing Your Home Multiple Times

- Conclusion

What Does it Mean to Refinance Your Home?

Refinancing refers to the mortgage that you obtain to replace the current one. Here, your lender pays off your existing mortgage, hence the term refinancing. As a result, you can shorten your loan term, lower your interest, or convert your equity into extra cash. There are two types of refinancing:

- Rate and Term Refinancing: With a rate and term refinance, you get a new mortgage with a lower interest rate. And, if possible, a shorter payment term. The latter, however, depends on the market.

- Cash-out Refinancing: With a cash-out refinance, you can borrow up to 80% of your home’s value for cash. However, even though you get lower interest rates, the loan amount could increase. This leads to larger payments or longer loan terms.

Is it Bad to Refinance Your Home Multiple Times?

Refinancing multiple times is not a good idea. However, you can do it, and if done right can benefit you in the long run.

In other words, you can refinance as many times as you want as long as it makes financial sense. And your lender should also allow it. But, furthermore, you need to be aware of the hidden risks and the associated costs. Otherwise, you are bound to end with more debt.

HOW MANY TIMES SHOULD YOU REFINANCE YOUR HOME?

There is no legal limit to the number of times you can refinance your house. But, it is not a good idea to refinance your home again and again in a short period of time. The decision, however, comes down to numbers. The general rule is that you should be able to save money. And for that to happen, you need to consider the following:

WAITING PERIOD

Depending on the loan type, your lender may or may not impose a waiting period.

For a conventional loan such as rate and term refinance, you do not have a waiting period. However, for a government-backed loan, you need to hold on to your mortgage for at least six months. In the case of cash-out refinances, you would have to wait for six months from the closing date. Additionally, you need to build enough equity in your home.

Apart from this, your lender may also have a “seasoning period”. During this time you cannot refinance with the same lender. The seasoning period is generally six months after the closing date. However, it doesn’t mean that you cannot refinance using a different lender.

LENDER’S STANDARDS

As with every other loan, first and foremost, you should be able to meet the lender’s standards. Anything may have changed from the last time you refinanced. You may have acquired more debt, less credit score, or reduced income. Whatever it may be, it can affect your eligibility. Other factors that make up the lender’s standards are the equity and DTI ratio.

CLOSING COSTS

Refinancing is quite similar to that of a mortgage. In that sense, you have to pay closing costs which may be anywhere between 2% to 5% of the loan principal. Some fees included are:

- Appraisal Fees: Even if you had an appraisal in recent times, your lender would also require another before refinancing. This is done to ensure that they pay according to the value of your home and not too much.

- Application Fees: No matter you receive a refinancing or not, you need to pay an application fee.

- Attorney Review Fees: Few states require an attorney to review and finalize your loan. In such an event, you would have to pay attorney fees. The fees can change depending on the state you reside in.

- Inspection Fees: Depending on the state, you may also have to get your home inspected. While a few states require an inspection every time you refinance, others every 5-10 years.

- Title Search and Insurance: A new lender may require you to pay for the title search to confirm the ownership of the property.

PREPAYMENT PENALTIES

Most lenders penalize you if you pay to settle your mortgage before the loan term ends. For example, say your lender has a clause that says you cannot pay off your loan within five years. If you refinance your mortgage loan within five years, you may have to pay everything you have saved in interest.

This may cause you issues if you have already refinanced and reset your loan term. Read the loan documents before applying for new refinancing.

LOAN-TO-VALUE (LTV) RATIO

The loan-to-value (LTV) ratio is essential when you seek a cash-out refinance. Most mortgage lenders require you to maintain an LTV ratio of 80%. And hence they restrict the amount you withdraw from your equity. Unfortunately, they do not allow you to withdraw 100%.

How Long Do You Have to Wait Between Refinancing?

Depending on the home loan and refinancing, you may or may not have to wait in between refinancing. Refinance rules vary depending on the mortgage, whether it is a conventional or government-backed loan.

REFINANCING FHA LOANS

FHA loans are those insured by the Federal Housing Administration. It has a few refinances on its own, governed by different rules.

- Rate and Term: Lenders require you to wait for seven months (six monthly mortgage payments). All the mortgage payments within this time period should be paid on time. And one late payment before that.

- Cash-out: You must own and occupy the home you are refinancing. In addition, you must have had a mortgage for at least six months and without any late payments.

- FHA Streamline: It is one of the easiest FHA refinances since it doesn’t have much paperwork. And no appraisal either. You must have held a mortgage for seven months with at least six monthly payments. All payments should be on time.

REFINANCING VA LOANS

VA loans are those that are backed by the Department of Veterans Affairs. The rules are the same for both the IRRL or VA cash-out refinance. You have to wait for seven months (210 days) or six monthly payments, whichever comes first.

REFINANCING USDA LOANS

USDA Loans are financed by the U.S. Department of Agriculture. They have two loans, and the refinancing rules differ for both of them:

- Guaranteed loan: You must have held the mortgage for a minimum of 12 months.

- Direct loan: There is no waiting period.

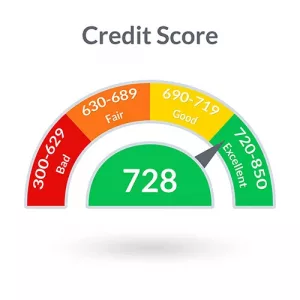

Does Refinancing Your Home Hurt Your Credit Score?

Yes! Refinancing does hurt your credit scores. However, any credit hit is likely to be short-lived and can revive soon after. The primary reason for the credit hit is the hard credit inquiry your lender does as a part of the qualification process. Any hard inquiry is recorded and affects your score for the time being.

Yes! Refinancing does hurt your credit scores. However, any credit hit is likely to be short-lived and can revive soon after. The primary reason for the credit hit is the hard credit inquiry your lender does as a part of the qualification process. Any hard inquiry is recorded and affects your score for the time being.

Another factor that affects the credit score is the new loan itself. It affects the length of the credit history with the new term and the amount owed. Finally, closing the current loan may also reduce your score.

Is it Worth Refinancing Your Home Now?

Experts say it is worth refinancing your home if the mortgage rates are lesser than your current interest rate by at least 1%. While it is a broad generalization, you may also consider the below reasons:

- Pay off the existing loan faster.

- You have enough equity built up to refinance into a new mortgage without mortgage insurance.

- Tap into the equity with a cash-out refinance.

Why Do Homeowners Refinance Multiple Times?

There are many reasons why homeowners may want another refinancing. The most important of it all is the low interest rate and monthly mortgage payment. Here are a few other reasons why homeowners refinance multiple times.

TAKE A LOW-INTEREST MORTGAGE

The interest rates have been the lowest in recent times. Make use of the current situation and refinance your mortgage to your advantage. Moreover, by not changing the duration, you can save money owed on interest payments.

LONGER-TERM LOAN

Utilize refinancing to increase the repayment period if you have trouble making the minimum payment. By increasing the duration of the loan, you can ease the strain until your financial situation improves.

A point often overlooked is that the longer your term, the more amount you pay in interest.

LOWER MONTHLY PAYMENT

With a mortgage refinance, you can also lower monthly payments by increasing the term. That, combined with a low interest rate, can ease your financial burden.

REMOVE PRIVATE MORTGAGE INSURANCE (PMI)

Lenders require you to have Private Mortgage Insurance (PMI) if you put down a down payment of less than 20%. You can refinance into a conventional loan provided you have a 20% equity built in your home.

Lenders require you to have Private Mortgage Insurance (PMI) if you put down a down payment of less than 20%. You can refinance into a conventional loan provided you have a 20% equity built in your home.

CONSOLIDATE DEBT

With refinancing, you can consolidate a high-interest debt such as:

- Student Loans

- Personal Loans

- Credit Card Debt

- Car Loans

You can save money from the interest payments by exchanging these debts for one with a low interest rate. However, the potential savings are affected if you are increasing the terms. Unless you are careful, it may even bite into your credit cards, leaving you with more debt.

TAP INTO EQUITY

Refinancing your existing mortgage into a new loan allows you to tap into the home equity. You can either use the loan balance after paying off your old loan to:

- Consolidate Debts

- Sponsor Home Improvements

- Build Emergency Funds

How Often Can You Refinance Your Home Loan?

You can refinance a mortgage as often you’d like. However, you may have to meet the eligibility standards every time you refinance.

- A credit score of 600 – 620, depending on the refinancing

- Steady income

- A low debt-to-income (DTI) ratio

- Good home equity of at least 20% (for better refinance rates)

What Is the Average Time to Refinance a Mortgage?

The average time taken to refinance a mortgage is 30 days. However, it can be as low as 15 days and can go as high as 45 days depending on the below factors:

- Appraisals

- Inspections

- Your Financials

- Credit Checks

- Lender’s Ability to Handle Loans

Then there are circumstances like the pandemic when the average time increased. The uncertainty and the changes in credit requirements led to unexpected delays.

How Much Money to Borrow When Refinancing Your Home

You can borrow anywhere between 75 – 90% of the value of your home when refinancing. The amount, however, depends on your eligibility and the lender’s rules. You cannot borrow the remaining 25 – 10% as it is retained as equity.

Drawbacks of Refinancing Your Home Multiple Times

It is a known fact that refinancing helps you save money. However, there are potential risks and pitfalls when you are refinancing your home multiple times:

It is a known fact that refinancing helps you save money. However, there are potential risks and pitfalls when you are refinancing your home multiple times:

HIGH CLOSING COSTS

Refinancing doesn’t come free but rather with closing costs and prepayment penalties. Unless you calculate the break-even point, you will end up losing more on these expenses.

INCREASED INTEREST EXPENSES

You are losing too much money on interest expenses over the period of your loan. Your payments in the initial years go towards interest rather than building equity.

LONGER LOAN PERIOD

Your savings will be high if you have a low repayment period along with a low interest rate. However, with a longer loan period, you will end up paying more than you borrowed.

LOSING PROTECTION

States like California provide buyers with extra protection. According to this, the banks cannot sue if you go into foreclosure. With refinancing, you tend to lose a layer of protection. Check the loan documents if the refinancing does so too. If not, it is better to back off.

LESS FLEXIBILITY TO MEET OTHER FINANCIAL GOALS

If you refinanced your home loan for lower terms and interest rates, you might want to think again. Due to increased monthly payments, you would not be able to save anything much, even a retirement fund.

Conclusion

The current interest rates may tempt you to refinance multiple times. According to the rules, there’s no limit to the number of times you can refinance the loan. However, you may want to proceed, only if it makes any financial sense. The below factors may affect the financial benefits you reap from refinancing:

- Closing Costs

- Prepayment Penalties

Homeowners can pay these as cash or wrap them into the loan, increasing the loan principal. The refinancing loan will also have a slightly higher interest rate.

If tapping into the equity is your goal, you can take out a home equity loan or a home equity line of credit (HELOC). They generally have low interest and also lets you borrow against the built-up equity. Another option is a personal loan. It is also an excellent way to borrow without risking your home.

Other related articles you may enjoy: