How Much Home Can You Afford? Complete Calculator Guide

One of the first questions every homebuyer asks is: “How much house can I actually afford?” The answer isn’t just about what a lender will approve you for—it’s about finding a comfortable payment that fits your lifestyle and financial goals. Here’s everything you need to know about calculating your home affordability in 2026.

The 28/36 Rule: Your Starting Point

The most widely used guideline in mortgage lending is the 28/36 rule, which provides a framework for understanding how much of your income should go toward housing costs.

The rule breaks down into two parts:

Front-End Ratio (28%): No more than 28% of your gross monthly income should go toward housing expenses. This includes your mortgage principal, interest, property taxes, homeowners’ insurance, and HOA fees if applicable.

Back-End Ratio (36%): No more than 36% of your gross monthly income should go toward all debt payments combined—including your mortgage, car loans, student loans, credit card minimums, and any other recurring debt obligations.

While many lenders may approve you for higher ratios (sometimes up to 43-45% on the back end), the 28/36 rule helps ensure you have breathing room in your budget for savings, emergencies, and lifestyle expenses.

Real-World Example: Breaking Down the Numbers

Let’s say you earn $80,000 per year, which equals approximately $6,667 in gross monthly income.

Front-End Calculation (28%): $6,667 × 0.28 = $1,867 maximum monthly housing payment

Back-End Calculation (36%): $6,667 × 0.36 = $2,400 maximum total debt payments

If you have $400 per month in car payments and $150 in student loans, you have $1,850 remaining for your mortgage payment ($2,400 – $550 = $1,850). This closely aligns with your front-end ratio, making you a strong candidate.

Using current mortgage rates around 7% with a 30-year fixed loan, this payment would support a home price of approximately $275,000 with 10% down, or about $310,000 with 20% down.

Key Factors That Determine Home Affordability

1. Your Gross Monthly Income

This is your pre-tax income from all sources—salary, bonuses, commissions, rental income, or side business revenue. Lenders want to see stable, verifiable income that you can document through pay stubs, tax returns, and bank statements.

The higher your income relative to your debts, the more home you can afford. If you’re married or buying with a partner, you can combine incomes to increase your purchasing power.

2. Your Monthly Debt Obligations

Your debt-to-income ratio (DTI) is one of the most critical factors lenders examine. This includes:

- Car loans and leases

- Student loans

- Credit card minimum payments

- Personal loans

- Child support or alimony

- Other mortgage payments (if you own rental property)

What’s NOT included: utilities, groceries, insurance premiums (other than mortgage insurance), cell phone bills, and other living expenses that aren’t debt obligations.

Pro tip: Paying down debt before applying for a mortgage can dramatically increase your buying power. Eliminating a $300 monthly car payment could increase your home budget by $50,000 or more.

3. Down Payment Amount

Your down payment directly affects both your loan amount and your monthly payment. Here’s how different down payment percentages impact your purchase:

3.5% Down (FHA minimum): On a $300,000 home, that’s $10,500 down with a loan of $289,500

5% Down (Conventional minimum): On a $300,000 home, that’s $15,000 down with a loan of $285,000

20% Down (PMI threshold): On a $300,000 home, that’s $60,000 down with a loan of $240,000

The more you put down, the lower your monthly payment and the less you’ll pay in interest over the life of the loan. Plus, 20% or more down eliminates private mortgage insurance on conventional loans, saving you $100-200+ per month.

4. Interest Rates

Even small changes in interest rates significantly impact affordability. On a $300,000 loan:

- At 6.5% interest: $1,896 monthly principal and interest

- At 7.0% interest: $1,996 monthly principal and interest

- At 7.5% interest: $2,098 monthly principal and interest

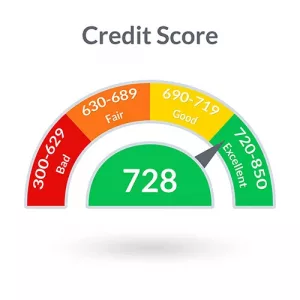

That 1% difference costs you about $200 per month, or $72,000 over 30 years. Your credit score plays a major role in the rate you’ll receive, which is why improving your credit before applying can pay off substantially.

5. Additional Housing Costs

Remember that your mortgage payment includes more than just principal and interest:

Property Taxes: In Tucson, annual property taxes average about 0.72% of the home’s value, or approximately $225 per month on a $375,000 home.

Homeowners Insurance: Expect $800-1,500 annually in Arizona, or roughly $70-125 per month.

HOA Fees: If applicable, these can range from $50 to $500+ monthly depending on amenities.

Mortgage Insurance: If you put down less than 20% on a conventional loan, or any amount on an FHA loan, you’ll pay mortgage insurance.

What Home Price Can You Afford in Tucson?

With Tucson’s median home price currently around $315,000-$375,000, depending on the data source, let’s look at what income levels support these prices:

For a $315,000 home (7% interest, 10% down):

- Monthly payment: approximately $2,250 (including taxes and insurance)

- Minimum annual income needed: $96,000

- Recommended annual income: $105,000+

For a $375,000 home (7% interest, 10% down):

- Monthly payment: approximately $2,700 (including taxes and insurance)

- Minimum annual income needed: $115,000

- Recommended annual income: $125,000+

These calculations assume minimal other debt. If you have significant car payments or student loans, you’ll need a higher income to qualify comfortably.

Beyond the Numbers: Other Affordability Considerations

Maintenance and Repairs

Budget 1-2% of your home’s value annually for maintenance and repairs. On a $350,000 home, that’s $3,500-7,000 per year, or about $300-600 monthly. This covers routine maintenance, appliance replacements, HVAC service, and unexpected repairs.

Utilities and Services

Homeownership comes with higher utility costs than renting. In Arizona, expect:

- Electricity: $150-300+ monthly (higher in summer due to AC)

- Water/sewer: $75-150 monthly

- Trash: $25-50 monthly

- Internet: $60-100 monthly

Closing Costs

Don’t forget you’ll need 2-5% of the purchase price for closing costs, in addition to your down payment. On a $350,000 home, that’s $7,000 to $ 17,500 in additional upfront costs.

Emergency Fund

Maintain 3-6 months of expenses in savings after your down payment. Homeownership brings unexpected costs, and you want a cushion for both emergencies and regular home maintenance.

How to Increase Your Home Affordability

1. Improve Your Credit Score: Every 20-point increase in your credit score can lower your interest rate by 0.125-0.25%, potentially saving you tens of thousands over the loan’s life.

2. Pay Down Existing Debt: Reducing your DTI by paying off credit cards or auto loans frees up more of your income for a mortgage payment.

3. Increase Your Down Payment: Save more for a larger down payment to lower your loan amount, reduce monthly payments, and potentially eliminate mortgage insurance.

4. Consider First-Time Homebuyer Programs: Arizona offers down payment assistance programs and favorable loan terms for first-time buyers that can make homeownership more accessible.

5. Shop Multiple Lenders: Interest rates and fees can vary significantly between lenders. Getting quotes from at least three mortgage lenders ensures you’re getting the best deal.

6. Expand Your Search Area: Different neighborhoods in Tucson have vastly different price points. Areas like Rita Ranch, Marana, or Oro Valley might offer better value than central Tucson locations.

When to Wait vs. When to Buy

You’re ready to buy if:

- You have stable employment and income

- Your credit score is 620 or higher

- You have enough saved for the down payment and closing costs, plus an emergency fund

- Your DTI ratios are comfortably within the 28/36 guidelines

- You plan to stay in the area for at least 5 years

Consider waiting if:

- Your job situation is uncertain

- You have high-interest debt to pay off first

- You don’t have an emergency fund

- Your DTI ratios exceed 43%

- You might relocate within the next few years

The Bottom Line: Find Your Comfortable Number

What you can afford and what a lender will approve aren’t always the same number. Just because you can qualify for a $400,000 home doesn’t mean that the payment will be comfortable for your lifestyle.

Consider your complete financial picture: retirement savings goals, children’s education funds, travel plans, and quality of life. A house payment that consumes all your available income might get you into a bigger home, but it could also create financial stress and limit your ability to enjoy life.

The best home affordability calculation accounts for both the numbers and your personal comfort level with debt and monthly obligations.

Ready to Determine Your Budget?

The first step toward homeownership is understanding exactly how much home you can afford. Our experienced loan officers at Altitude Home Loans can help you calculate your buying power, explore different loan options, and create a strategy that fits your financial situation.

Get pre-approved today to know your exact budget before you start house hunting. Contact us to speak with a loan officer who can provide a personalized affordability analysis based on your unique circumstances.

Yes!

Yes!  Lenders require you to have

Lenders require you to have

Buying a home is many American’s ideal goals, but the process involved in buying one is complex. Before purchasing a home, you need to make sure your credit and finances are in order. You’ll need to fill out different paperwork and submit various forms of verification before securing a home. Unless you plan on buying your home upfront, you’ll need to finance through a bank.

Buying a home is many American’s ideal goals, but the process involved in buying one is complex. Before purchasing a home, you need to make sure your credit and finances are in order. You’ll need to fill out different paperwork and submit various forms of verification before securing a home. Unless you plan on buying your home upfront, you’ll need to finance through a bank.