The mortgage industry is a significant part of the US economy and is one of the biggest in the world. The mortgage rates are at an all-time low of 3.08% as of March 2021, spurring many home buyers. However, the mortgage process is quite daunting, especially for a first-time buyer. It is not always that you enter into debt with that many zeros.

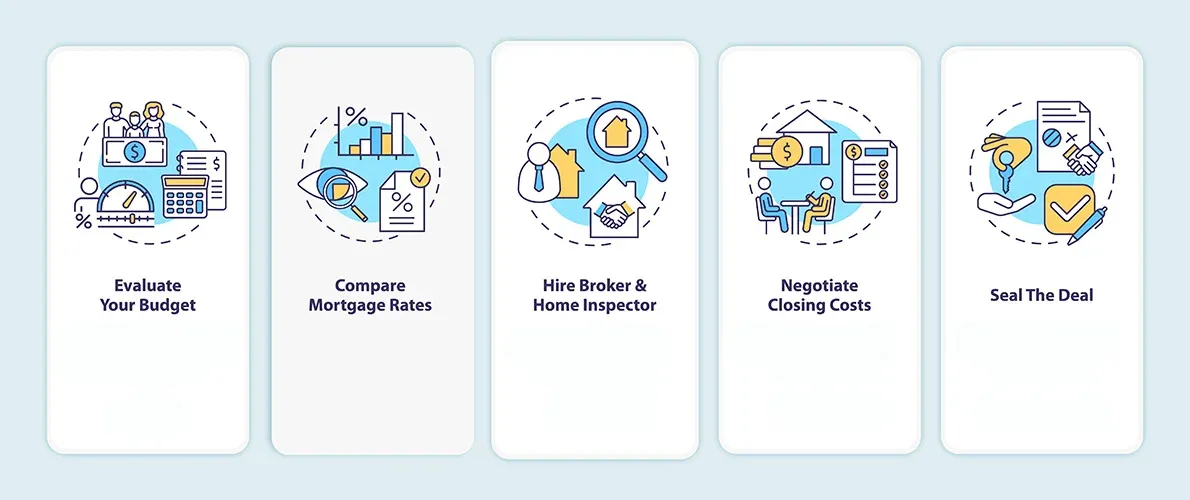

A proper understanding of the mortgage loan process increases the chances of approval. Not only that, but it also helps you ask the right question. The process follows the following distinct steps including:

- Budget Estimation

- Pre-approval

- House Hunting

- Mortgage Application

- Underwriting

- Closing

In this article, we take you through the mortgage loan process in detail from budgeting to closing.

The Process of Getting a Mortgage

A mortgage is a type of loan used to finance a property, the latter being the collateral. It is generally a secured loan where the lender holds your property in collateral until the loan is paid in full.

The mortgage process itself starts with the borrowers applying with one or more lenders. The latter requires proof of the borrower’s repaying capability, including bank statements, tax returns, and employment proof. Furthermore, the lender will also run a credit check as a part of the loan approval process.

Once the loan is approved, the lender offers a preapproved amount at a specific interest rate. Buyers also have the option of applying for the loan before buying a home called preapproval. This gives you an edge in a tight property market.

Once the buyer, seller, and the lender agree, they come together for a closing meeting. At this point, the buyer makes the down payment to the mortgage lender. The seller then transfers the ownership to the buyer and receives the purchase price.

What Is the First Step in Getting a Mortgage?

The first step in any mortgage process is research. As with any significant financial decision, take time out to research the market. First, list the properties and the neighborhoods you like, followed by the asking prices. Next, see how long the houses stay in the market. This gives you an idea about the housing trend of the region.

Furthermore, take time to understand the process and the steps involved. That way, you know what to expect and get everything ready from your end.

15 Steps of a Mortgage Loan Process

Buying a new home is a big step yet exciting phase for everyone involved. However, the all too important mortgage can be overwhelming. Understanding the process and the technicalities can help you make the right decisions. Moreover, it also helps you to stay organized and be in control.

1. Prepare Your Budget

It is safer to kick off the mortgage loan process with a budget estimation. In many ways, that helps you to set realistic expectations not only with the house but also the mortgage.

Your purchase price should be three to five times the annual household income as a rule of thumb. This excludes the 20% down payment. Also, take into consideration your debt and financial situation.

Alternatively, you can also calculate the maximum monthly mortgage payment you can afford. Then work backward towards the maximum house price you can afford. According to the US Census Bureau’s 2019 American Housing Survey, the median monthly mortgage payment is $1200.

The mortgage payments include the principal, interest, and the homeowner’s insurance. When you focus on the monthly payment, your budget will account for all the ongoing costs.

2. Get Your Finances in Order

With the budget ready, assess your finances to see if you are ready to buy a new house? Have you saved enough for a down payment and closing costs? What about your debts? And get ready to have your financials probed.

Buying a home is the most significant financial investment of your lifetime. So, it’s no wonder your lender goes through your financials with a fine-toothed comb. They are wary of substantial debts like student loans and car loans. If you are laden with debt, you may want to take a step back and improve your financial health.

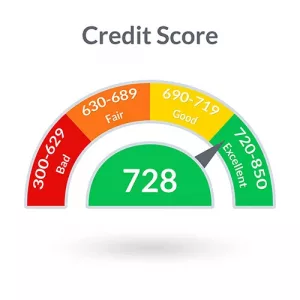

Another point to note is the credit score. Lenders scrutinize your credit history for any cases of discrepancies. The minimum credit score requirement for home loans ranges between 580-620. A higher credit score warrants a better interest rate.

To improve your credit score:

- Pay outstanding debts

- Do not open new accounts

- Avoid too many credit inquiries

- Dispute errors in your credit report (if possible)

The final point to note is the debt to income ratio. It is a measure of your debt (credit card, car loan, personal loan, and student loan) and your income. A low debt to income ratio increases your chances of loan approval.

3. Choose the Right Mortgage

Have you decided what kind of mortgage you are looking for? Remember, the interest rate also depends on the mortgage that you choose. Moreover, the eligibility criteria also vary depending on the loan.

There are four major loan programs:

VA Loan – Backed by the Department of Veterans Affairs, VA loans are available only for veterans or active service members.

FHA Loan – Insured by the Federal Housing Administration, this loan has a low credit score minimum.

USDA Loan – Backed by the U.S. Department of Agriculture, the USDA loans are suitable for lower-income borrowers.

Conventional Loan – The government does not insure conventional loans. And hence have strict eligibility criteria. They are suitable for people with solid credit.

Of the above-mentioned loan programs, the mortgage rates for the VA loans are often the lowest.

4. Down Payment

Coming to down payments, VA loans and USDA loans do not need any down payment. Furthermore, FHA loans require a 3.5% down payment and conventional loans 3%. However, they will incur mortgage insurance. With a larger down payment of, say, 20%, you can avoid mortgage insurance. The issue with low or no down payments is that you’ll have to pay private mortgage insurance, which reflects on the monthly payments.

5. Research Mortgage Lenders

From traditional banks to credit unions and online lenders, you have many options. Your choice of mortgage lender depends on the mortgage that you choose. For example, if you choose a VA mortgage, the lender works with military/veteran borrowers.

You may want to consider:

- The lender’s minimum qualifications should align with that your requirements.

- Do the interest rates include points? Points are paid fees upfront to reduce the interest.

- How do you want to communicate with the lender? If you do not care about an in-person service, you can go for an online service as well.

- Does the lender provide financial services such as down payment assistance?

It is wise to get pre-approved by three mortgage lenders. That way, you can compare the interest rates and choose the one that saves you money. Even a .5% difference in rates can save you thousands of dollars in the loan duration.

6. Get a Mortgage Pre-Approval

A mortgage pre-approval ensures that you have a smooth buying experience. It shows the real estate agent and the seller that you are ready and equipped to buy. Moreover, it gives you an upper hand over the other buyers since you already qualify for a home loan.

Preapprovals are generally a letter from the mortgage lender containing the approved amount. This is based on your savings, credit score, and current income. The lender may also look at your income and asset documentation. Preapproval letters are easy to get provided you prove your eligibility.

Another critical point to remember is that pre-qualification is not pre-approval. The former is a measure of the borrower’s ability to get a mortgage loan. It requires no verification or credit check. On the other hand, the latter means that you are qualified for a loan.

7. Prepare Your Documents

Before the pre-approval, you need to get your documents ready. Gathering the documents ahead reduces the stress, letting you concentrate on house hunting. Then, when the time comes, hand the documents over to the loan officer.

The loan officer will create a loan file with the necessary documentation. The first of which is the mortgage application and credit report. Here are some of the documents you need to have in hand:

- W2-forms (two years)

- Pay stubs (30 days)

- Federal tax returns (2 years)

- Other sources of income

- Recent bank statements (2 months)

- Documentation related to long-term debts such as car loans and student loans

- Identification card: State issued driver’s license or valid passport

- Social security number

- Profit and loss statements if self-employed(2 years)

- Documentation related to child support and marriage alimony.

- Details about your recent deposits in your bank account with proof

- Documentation for any gift certificate or other funds used in your down payment

8. Hire a Real Estate Agent

A skilled real estate agent is critical for your house-hunting process. They can help you look for houses within your budget and in your desired neighborhood. They also guide you through the home buying process. Real estate agents see thousands of homes every year. As a result, they will have a list of homes that fits within your budget along with the features you desire.

9. Get House Hunting

With everything in hand, you can jump right into house hunting. Your agent will have a list of properties for you to look into. Visit the properties with your agent. Choose that you could imagine living with your family.

Depending on your budget, you may not get everything that you desire. Make a list of features arranging based on the priority. This will help you choose the right one that meets your needs.

10. Make an Offer

Now that you have chosen the one that caught your eye, it is time to make an offer. Your real estate agent will now prepare the offer. They will know how to structure the offer and the contingencies to add. So, it’s better to leave them to it. The details in this agreement are negotiable. The sellers may want to make changes and add contingencies from their end as well.

When you make the offer, consider making an earnest money deposit. This is a cash deposit made to show that you are serious about securing the house. It can be as little as $500 or as much as 5% of the purchase price. The earnest money depends on the local custom, so it is safer to keep the real estate agent in the loop.

11. Get a Home Inspection

Once your order is accepted, you may want to get a home inspection firsthand. It gives you an idea about the stability of the house and also the repairs needed (if any). Some of the critical areas the home inspector checks are:

- Foundation

- Roofing

- Home’s Structure

- Plumbing

- Electrical

You can use any issues uncovered during a home inspection for negotiation before arriving at a final purchase price.

12. Apply for the Mortgage

You would have completed the mortgage application process during the pre-approval stage. If not, you would have to apply now.

Even with the pre-approval, you would have to submit final documentation before underwriting. For example, your lender would need the purchase agreement and proof of earnest money. Furthermore, they would also require the current income and asset documentation. And any other documents missed during the preapproval.

Within three business days(may change depending on your lender), you will get a loan estimate. The estimate contains the terms and conditions, interest rates, and fees.

13. Have the Home Appraised

The lender will set up an independent appraisal process. This protects you from paying more than the house is worth. During the process, the house is evaluated against similar properties in the same neighborhood.

If the appraised value is lower than the purchase price, you have three options to choose from:

- First, pay the difference from your pockets at the time of closing.

- The seller has to lower the value.

- Walk away from home, provided you have the appraisal clause in the purchase agreement.

14. Mortgage Underwriting

Once the purchase agreement is finalized, it is sent to your banker, who then reviews your options. During the underwriting process, the underwriter verifies your income, debt, assets, and employment.

Since the preapproval lasts for only 90 days, your lender may recheck your credit reports. Therefore, refrain from taking on additional debts for this time being and put your loan in peril.

As a final step, you and the lender will decide when to lock in the mortgage rates. A mortgage rate lock will ensure that the interest remains the same until closing. The lock stays in place for 30-60 days.

Also, the title insurance is brought forward before closing. This is also when you make sure that the seller meets the contingencies as per the agreement.

15. Get Ready to Close

Once the underwriting is complete, the closing meeting is scheduled. It happens either at the attorney’s office (or title company). You’ll need to bring the following documents:

- Photo ID

- Closing Disclosure

- Down Payment

- Closing Costs

Of these, the closing disclosure is the most important. The loan estimate gave you the predicted cost, while disclosure confirms those costs. Above all, these should match without differing too much.

Regarding the closing costs, you have the option to:

Once everything is in order, checked, and signed, you can receive the keys for your property.

How Long Does It Take to Complete the Home Buying Process?

The process varies for everyone depending on the lender. Here’s an approximate time frame for your reference.

Pre-approval takes a day at the most, as long as you have the necessary documentation.

Closing can take as long as 30 days from the day you start underwriting. The lack of appraisers can delay the process. However, this may vary from county to county, especially if there is a shortage of appraisers.

Having the necessary documentation in hand may speed up the process.

Conclusion

Buying a home may seem long and complex from the time of pre-approval to closing. However, armed with the required knowledge, you can overcome any foreseen circumstances. Besides, you are in a better position to make the process go smooth for all the parties involved.

Before closing, if you start having second thoughts, you can back off at any point in the process. The mortgage loan process comes with mile-long paperwork.

Even though staying on top of it all is difficult, take your time to understand every step of the way. Keep track of what you are paying and signing lest you fall into a hole unable to come out of.

Proof of Income

Proof of Income You do not have to own a business to be self-employed. A mortgage lender considers the following people also to be

You do not have to own a business to be self-employed. A mortgage lender considers the following people also to be

Assets that have a cash value or can be converted to cash are called liquid assets. Lenders would want to verify that you have the means to pay the payments, insurance, taxes, and interest on your mortgage. The capability to pay for these is determined by the liquid assets, including bank account, savings account, checking account, stock option, etc. Experts suggest having six months of current income in liquid assets or cash to tide you over in times of financial emergency. This ensures that you can continue paying the mortgage payments even if you have no source of income.

Assets that have a cash value or can be converted to cash are called liquid assets. Lenders would want to verify that you have the means to pay the payments, insurance, taxes, and interest on your mortgage. The capability to pay for these is determined by the liquid assets, including bank account, savings account, checking account, stock option, etc. Experts suggest having six months of current income in liquid assets or cash to tide you over in times of financial emergency. This ensures that you can continue paying the mortgage payments even if you have no source of income. Title Search and Insurance

Title Search and Insurance The people at

The people at